VAT Return Filing

VAT Return Filing in the UAE

VAT return filing is a crucial aspect of the UAE’s tax system, ensuring businesses report the VAT collected and paid to the Federal Tax Authority (FTA) within a specific period. Proper VAT return filing helps businesses stay compliant and avoid penalties.

At A&A Associate, we provide comprehensive VAT return filing services in Dubai, handling all VAT-related matters efficiently and reducing your business’s tax burden.

What is VAT Return Filing in the UAE?

VAT return filing determines the amount of VAT a business needs to pay or reclaim from the tax authorities. Typically, businesses file VAT returns quarterly, allowing them to track their financial health while ensuring compliance with tax laws.

Failure to comply with VAT regulations may lead to penalties, affecting your business operations and financial stability.

How to Register for FTA VAT in the UAE

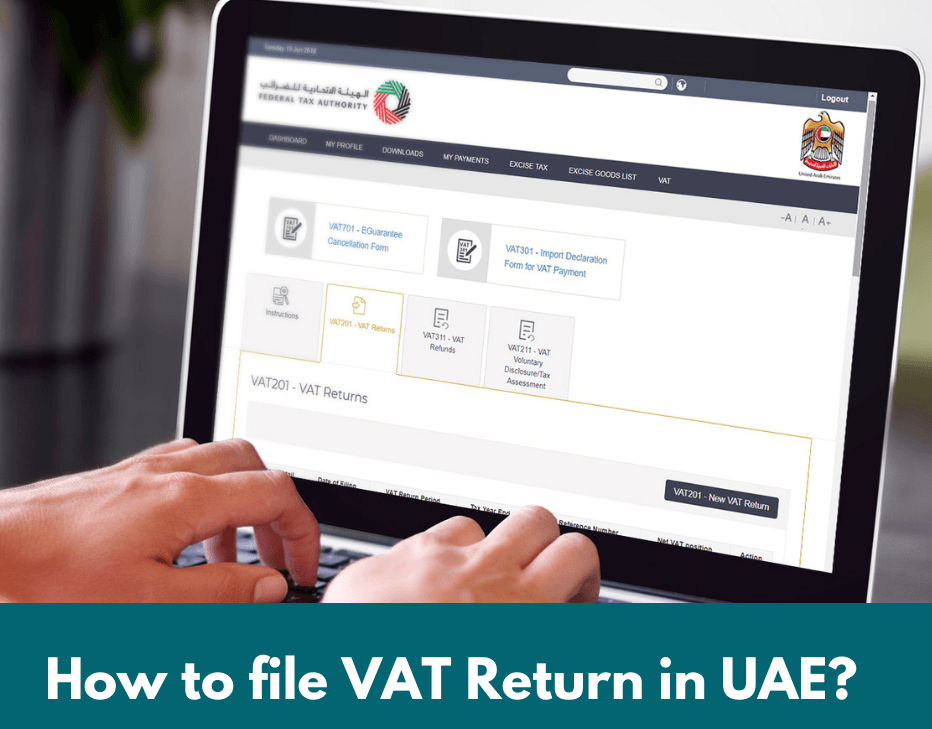

Step 1: Log in to the FTA e-Services Portal

- Access the VAT 201 return form from the FTA dashboard.

Step 2: Enter the Required Information

Businesses must provide details such as:

✔ Taxable person’s information

✔ VAT return period

✔ Sales and output VAT

✔ Expenses and input VAT

✔ Net VAT payable or refundable

✔ Additional report requirements

✔ Authorized signatory and declaration

Step 3: Submit VAT Return & Make Payment

- After submitting the VAT return, the FTA sends a confirmation email.

- The taxpayer must pay the due VAT via multiple channels, including:

- E-Dirham

- Bank transfers

- Exchange houses

- Over-the-counter payments

Value Added Tax (VAT) is a consumption-based tax applied to goods and services at each stage of the supply chain. The UAE introduced VAT on January 1, 2018, at a standard rate of 5%.

Value Added Tax (VAT) is a consumption-based tax applied to goods and services at each stage of the supply chain. The UAE introduced VAT on January 1, 2018, at a standard rate of 5%.

Why VAT Return Filing is Important for Businesses in the UAE?

Being VAT-compliant ensures that businesses avoid penalties and operate smoothly. Here are some key benefits of VAT return filing:

✔ Legal Compliance – Filing VAT returns protects businesses from legal risks.

✔ Encourages Investment & Savings – VAT promotes financial discipline in businesses.

✔ Transparent & Efficient Taxation – Reduces the burden on customers by spreading taxation across various stages.

✔ Improves Business Reputation – Many companies in the UAE prefer working with VAT-registered businesses.

✔ Easier Tax Management – VAT return filing is simpler than other indirect taxes, ensuring smooth tax administration.

VAT Fines & Penalties for Non-Compliance in the UAE

Failure to comply with VAT regulations can result in penalties. Below are some common violations and their associated fines:

🚨 Failure to register for VAT on time – AED 20,000 penalty

🚨 Late VAT deregistration – AED 10,000 penalty

🚨 Not displaying VAT-inclusive prices – AED 15,000 penalty

🚨 Late VAT return submission – AED 2,000 penalty per instance

🚨 Failure to maintain business records – Can lead to compliance issues and additional fines

🚨 Submitting incorrect VAT returns – AED 3,000 for the first mistake, AED 5,000 for subsequent errors

Common VAT Return Filing Mistakes Businesses Make

📌 Poor record-keeping – Not maintaining proper financial records

📌 Incorrect VAT calculations – Mistakes in VAT amount determination

📌 Lack of proper VAT planning – Failing to prepare for VAT obligations

📌 Hiring unqualified resources – Inexperienced staff handling VAT returns

📌 Issuing invalid tax invoices – Not following the correct VAT invoicing format

📌 Misunderstanding VAT laws – Incorrect input tax deductions due to legal misinterpretations

How A&A Associate Assists in VAT Return Filing in the UAE?

At A&A Associate, we provide professional VAT return filing services to ensure businesses comply with UAE tax laws while minimizing tax liabilities. Our services include:

✔ Compiling necessary documents for VAT filing

✔ Identifying tax-saving opportunities to reduce VAT liabilities

✔ Acting as your VAT representative before tax authorities

✔ Ensuring timely VAT returns to avoid penalties

VAT return filing doesn’t have to be complicated! Our experts simplify the process, ensuring transparency and compliance while maximizing your business profits.